As the rising cost of healthcare in the United States continues to outpace general inflation rates, even a handful of high-cost, catastrophic claims can put significant pressure on plan payers and the members that they cover.

And, while many strategies exist to manage these claim costs as they arise, most of them take a reactive approach, intervening only after the claim is submitted and the dollars start moving.

A more effective approach to high-cost claims management lies in a proactive, full-cycle strategy — one that identifies and prevents unnecessary spending before and after payment is issued.

Today, we’ll explore what that strategy looks like in action, the high-cost claims trends making it necessary, and how comprehensive payment integrity solutions can deliver significant savings for all involved in the healthcare continuum.

High-Cost Medical Claims: A Growing Burden for Health Plan Payers

While high-cost medical claims are nothing new, the financial risk they pose for health plans and health plan payers has become staggeringly disproportionate to the frequency at which they occur.

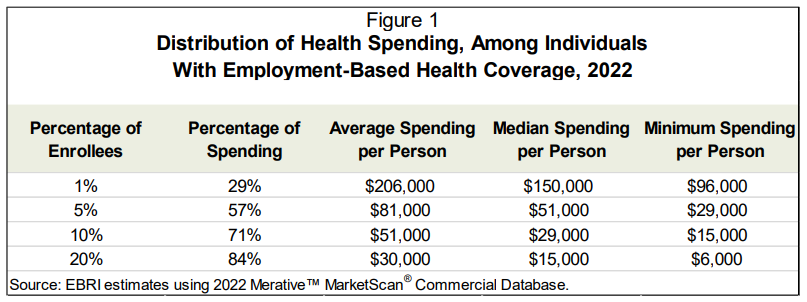

Payers have long been aware of the 80-20 rule, in which 80% of costs in a plan are incurred by 20% of members. Recent research from the Employee Benefit Research Institute (EBRI) confirms this (and bumps that number up to 84%).

Even more astonishing is the fact that 29% of plan spending can be traced back to just 1% of members, for which individual median spending each year is $150,000, with every person in the EBRI studied group incurring at least $96,000 in healthcare services in a single plan year.

Most of this spend can be traced back to the prevalence of chronic conditions such as heart disease, respiratory conditions, and musculoskeletal disorders. According to the EBRI research, members with these conditions accounted for 92% of all health spending in 2022 — a trend corroborated by Sun Life, which determined that 92% of all stop loss claims from 2020 to 2023 came from the top 20 high-cost conditions in its annual study, conditions which in turn have experienced a 38% average increase in cost since 2021.

As a result of these ongoing trends, today’s employers expect the total health benefit cost per employee to rise 6.5% on average in 2026, the highest increase since 2010.

It’s no wonder, then, that employers cite “managing high-cost claims” as their greatest focus for the year ahead. And while many will explore cost-containment solutions that shift expenses to employees (who can expect their paycheck deductions for health coverage to rise by 6% to 7% on average), cost-shifting is not a long-term solution for the high expenses plaguing both plan payers and members.

Instead, it’s time to invest in more proactive solutions — ones that identify and reduce those potential high-cost claims before they are paid in the first place.

Proactive Payment Integrity: High-Cost Claims Management for the Future

As the cost of healthcare continues to rise, it’s no longer sustainable (or effective) for plan payers to take a reactive approach to their high-cost claims management. Instead, modern claim management and review must be a full-cycle initiative, one that begins before services are even rendered.

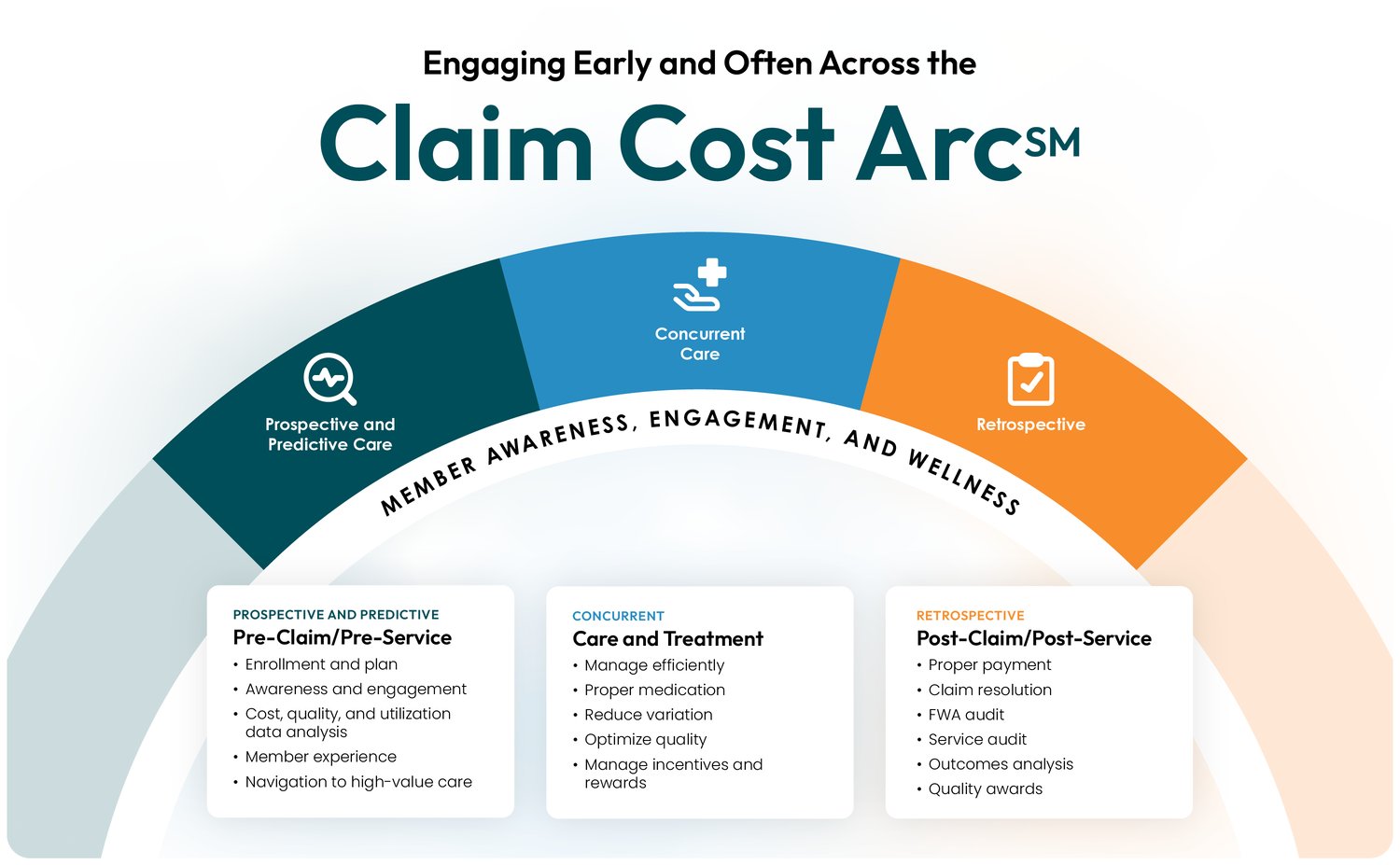

At Vālenz Health®, we refer to this cycle as the Claim Cost Arc℠.

By integrating tailored solutions that work across the complete cycle of claims review — from pre-service (prospective) to adjudication (concurrent) to post-payment (retrospective) — Valenz Payment Integrity delivers the highest possible savings for plan payers, as well as a positive healthcare experience for the members at the heart of it all.

Below, explore how our industry-leading Payment Integrity solutions uncover cost savings at every step of the claims process.

The Prospective Phase: Pre-Payment

Engaging early and often is a key principle of the work we do at Valenz and an integral part of our payment integrity strategy.

Using a proactive approach, we not only identify and resolve billing errors before they are paid — we also prevent high-cost claims from occurring in the first place.

With Valenz ABN Medical Necessity Validation, we deliver prior authorization tools that verify insurance eligibility and validate medical necessity in real time, stopping more than 90% of costly claim denials in their tracks to streamline claim processing. The Valenz Clean Claim Verification solution adds an extra layer of security, scrubbing claims for coding, coverage, and compliance errors to ensure any high-cost claims enter the processing journey correctly — further reducing avoidable denials or payment of non-covered services.

In cases where high-cost claims are unavoidable (such as complex surgeries), the Valenz payment integrity team steps in to minimize the cost of services before they are delivered.

By engaging in in- and out-of-network negotiation (part of the Valenz Clinical Bill Review solution), we mediate anticipated billing and costs ahead of time to secure more effective cost containment. Leveraging our Valenz Market-Sensitive (VMS®) repricing methodology, we reduce the risk of balance billing while ensuring fair reimbursements for providers and facilities.

In short, our pre-payment solutions are designed to improve care quality while decreasing costs — as they did in the case of one surgery, where we secured rapid provider sign-off while simultaneously delivering more than $900,000 in savings for the member and plan.

The Concurrent Phase: Claim Adjudication

In situations where high-cost claims cannot be remedied prior to initial billing, our team remains dedicated to cost containment with strategies designed specifically for the adjudication stage.

Our mission: Engage early and often on our client’s behalf to negotiate initial billed charges before any payment amount is made.

As in the prospective phase, we deploy the experts on our Clinical Bill Review team to conduct a line-item review of all billed charges. This way, we can identify any incorrect procedure or diagnosis codes that trigger expensive claim denials, future payment issues, and burdensome administrative costs — ensuring that appropriate charges are accounted for in every single claim.

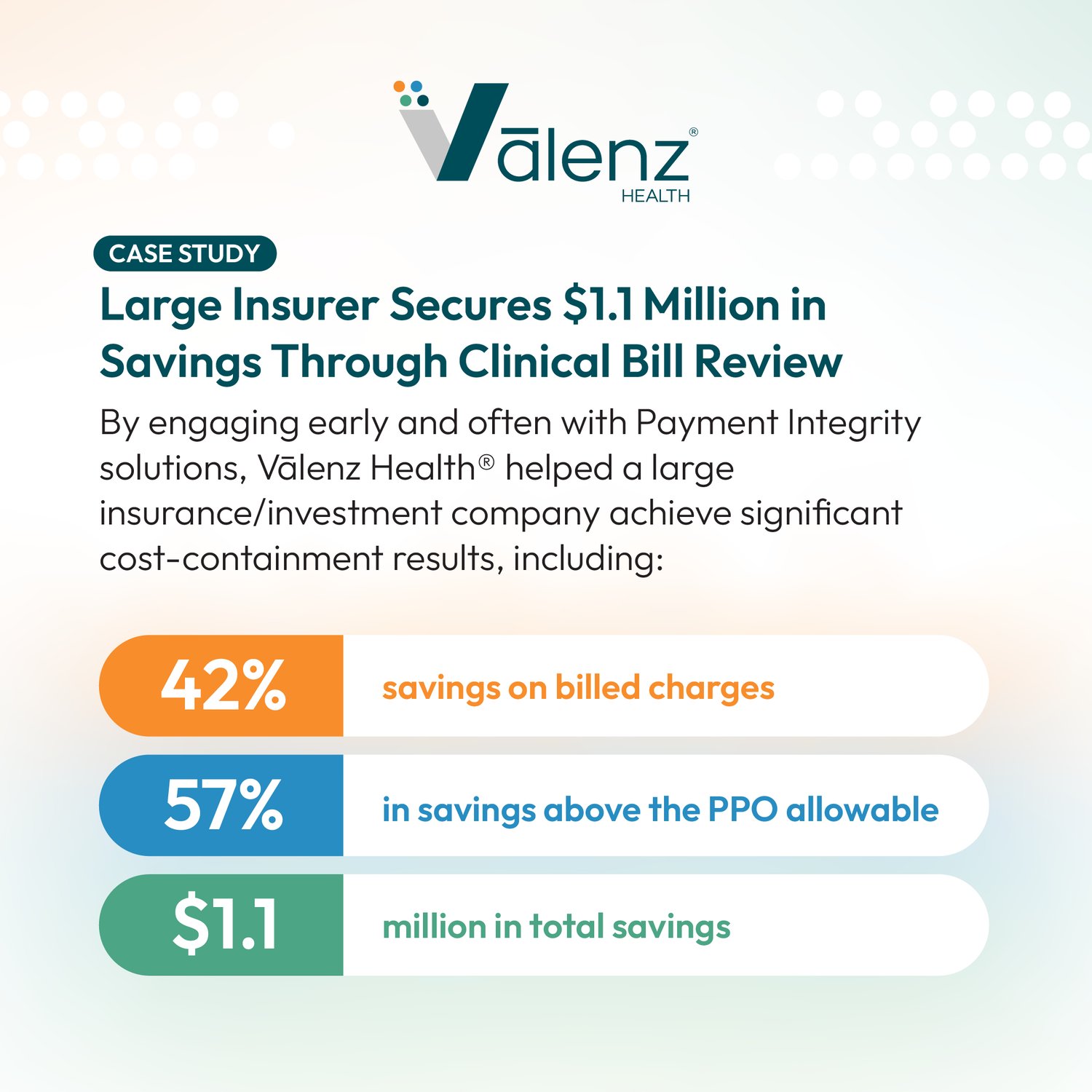

On average, our Clinical Bill Review solution delivers 30% in additional savings over contracted network discounts, with less than 1% of reviews appealed by providers. For one recent high-cost claim, the savings were even more impressive: 42% saved on billed charges for a total of $1.1 million in overall claim savings.

At the same time, we leverage the Valenz Out-of-Network Repricing solution to drive down the often unanticipated and extremely high-cost out-of-network claims that account for a significant percentage of our clients’ healthcare expenses. Specifically designed for uncommon claims like air ambulance, renal dialysis, and applied behavior analysis, our VMS Repricing methodology creates average savings of 67%, providing financial protection for unexpected member claims.

By embedding this repricing process directly into the TPA workflow, we help minimize the administrative burden involved, allowing third parties to validate and finalize pricing during the initial payment processing — eliminating any additional post-payment negotiation and fund recovery.

And, as we’ll discuss below, our commitment to delivering savings goes beyond this bill review, with assured payment options for balance billing that emerges after the adjudication stage.

The Retrospective Phase: Post-Payment

Even the most proactive of high-cost claim management strategies cannot completely eliminate the risk of improper payments or overpayments. That’s why the Valenz Payment Integrity team remains committed to serving clients through the very final stage of the claims process: the post-payment phase.

With our Clinical Bill Review solution, we can quickly uncover billing errors, duplicate payments, and incorrect reimbursements in previously paid claims to recover money spent erroneously on high-dollar claims, delivering an average 20% first-pass savings on all eligible expenses.

For an extra level of security, we also offer assured payment options as part of our Out-of-Network Repricing solution. Should balance billing occur after repricing negotiations in claims under $5,000, Valenz assumes responsibility for any amount owed to providers above the original VMS repriced allowable — providing peace of mind for plan payers and the members who receive the final service charges.

In an ideal world, a proactive payment integrity strategy makes post-payment recovery obsolete. While it’s what we strive for here at Valenz, we also know the reality of the healthcare system, which is why our team is as equally dedicated to your claims process during this stage as during other pre-payment phases.

In fact, we use learnings from our post-payment reviews to inform and improve the pre-payment and adjudication processes, as well.

Unlike other payment integrity providers, we don’t simply file away a claim after post-payment review is complete. Instead, our analytics team reviews data from across the entire lifecycle of the claim to identify common patterns and other helpful insights.

We then feed those learnings back into our pre-payment and adjudication processes, allowing us to continually improve our payment integrity strategy across the entire life cycle of a claim — delivering higher savings and a better experience for all parties involved.

Minimize Your High-Cost Medical Claims with Smarter Solutions from Vālenz Health®

If current healthcare trends hold (and there’s little reason to believe they won’t), high-cost healthcare claims will only grow in the years to come — leaving health plan payers and their members holding an increasingly large service bill.

Proactive high-cost claims management like that offered by Valenz will be key to reducing those expenses, not to mention the administrative time and energy required to manage the complex claims process from start to finish.

It’s important to note that, while a full-cycle payment integrity strategy will play a significant role in future high-cost claims management, it’s not the only investment that health plan payers should make with this future in mind.

By employing payment integrity solutions as part of an integrated healthcare system, we can all work together to minimize the likelihood of high-cost claims before they happen. Preventive care services, detailed care navigation, and other case management strategies are critical to empowering plan members with the information they need to make smarter healthcare decisions — from seeking proper preventive care to choosing high-value, low-cost providers for their service needs.

At Valenz, we are dedicated to simplifying healthcare with this integrated approach, not just to reduce costs but also to optimize the entire care journey for the members at the heart of the plan.

To learn more about what that strategy looks like for you — and how our Payment Integrity solutions can help you manage your high-cost claims — contact one of our team members below.

.png?width=375&height=375&name=reducing-high-cost-claims%20(1).png)