Today’s self-funded employers face a seemingly impossible challenge: balancing ever-rising healthcare costs with providing comprehensive, attractive benefits packages for their covered employees.

While cost-shifting models have historically made up the gap for plan payers, with 44% of Americans currently struggling to afford their healthcare costs, employers sponsoring insurance coverage now need more affordable plan designs to address employees’ rising dissatisfaction with existing benefits packages.

For many, that solution can be found in variable copay models.

As an innovative approach to cost-sharing in an expensive healthcare landscape, the variable copay system is rapidly gaining popularity among self-funded employers for its cost-containment and value-based care capabilities.

In today’s guide, learn more about what this model looks like, why it’s beneficial for plan sponsors like you, and how to smoothly transition to this system to deliver smarter, better, faster healthcare for your employees moving forward.

What is a Variable Copay Model?

A variable copay model is an alternative health plan design that guides plan members to high-quality, low-cost providers and facilities using a strategic pricing system.

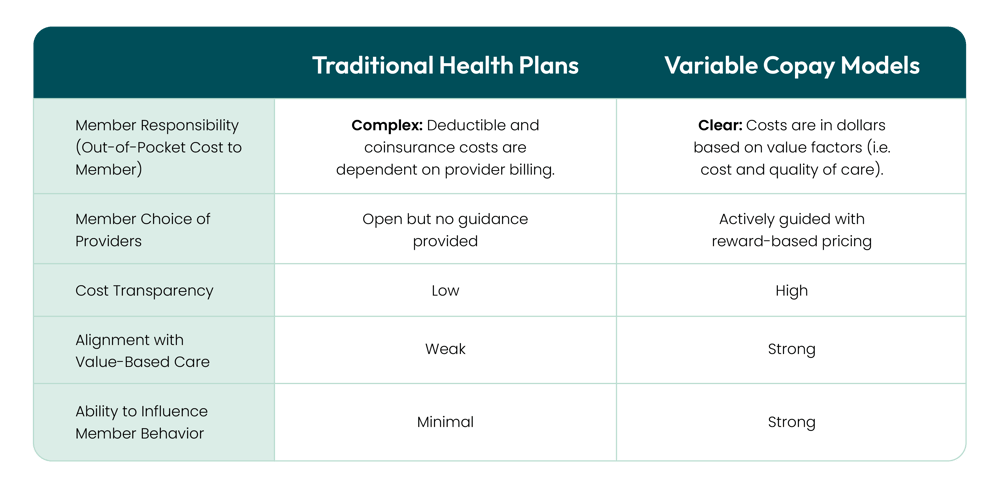

Unlike traditional copay models which assign a flat rate regardless of who provides the care or how efficiently it’s delivered, variable copay models assign lower copays to certain providers and facilities deemed “high value” by the plan design — i.e. those that are known to deliver better care outcomes at a lower cost for those procedures covered by the variable copay plan.

As a result, plan members are incentivized to select these lower-cost providers, reducing their own out-of-pocket costs and the plan’s overall healthcare spend.

Variable copay model designs can be customized based on several factors, including the type of service provided, the provider’s cost and quality rating, and the setting where care is delivered. Regardless of design, the goal remains the same: to incentivize smarter healthcare decisions by making high-value care more affordable with lower or zero deductibles or coinsurance.

Lower costs are just one benefit of the variable copay model. Some other advantages include:

- Improving member access to healthcare and adherence to treatment plans by making high-quality options more affordable

- Simplifying the member experience through clear, service-based copays

- Strengthening cost efficiency of the plan by applying savings automatically during claim processing

By implementing a well-structured variable copay model, employers create a win-win situation: lower costs for their business and improved healthcare affordability for employees.

It’s no wonder, therefore, that 20% of employers with 500 or more employees were considering a variable copay plan model for 2026 or 2027 — a number expected to grow as variable copays become more mainstream, especially among self-funded employers.

How Employers Can Manage the Shift from Traditional to Variable Copay Plans

As healthcare costs climb, self-funded employers like you need smarter ways to deliver value without breaking the budget. Variable copays create a strategic advantage by controlling healthcare costs while simultaneously supporting a workforce with high-quality, accessible care options.

Because variable copays are still relatively new to most employees, the key to success with these models is helping employees understand the change — and providing the tools to support them in choosing the smarter, more cost-effective care options that are now available via the plan.

Communicate the change effectively.

To effectively explain the shift from a traditional copay to a variable copay model, employers must use clear, proactive, and multichannel communication strategies that detail how pricing works with the health plan and what it means for employees.

The first step is to explain the “why.” Employees used to a traditional or high-deductible health plan design will likely be confused and frustrated by yet another change to an already complicated healthcare experience. Therefore, before you even begin educating your employees about how the model works, you must make it clear why the plan has changed: to help balance out-of-pocket costs, ensure access to necessary procedures and medication, and optimize healthcare spending for the entire plan.

After that, be consistent and clear with communication leading up to, throughout, and after the transition is complete. Consider the following:

- Send an initial email regarding the change, explaining the reasoning behind your decision, the benefits it will bring to employees, and the way the system works.

- Host a dedicated webpage on your benefits portal about the new structure, including cost examples for common procedures.

- Prepare your HR and benefits personnel to handle employee questions and concerns quickly and efficiently.

Remember: Member education is critical to the success of your variable copay plan. Research shows that the majority of Americans are interested in shopping for healthcare options, but a lack of awareness and understanding of the tools available to them have historically hindered the uptake and success of these programs.

For this reason, the most successful variable copay models are those that include member education and engagement, such as the proactive outreach offered by the Valenz Variable Copay solution (more on that below).

Provide supportive tools.

Implementing a variable copay system is no use if your members don’t also receive the tools necessary to understand and utilize the model to its full extent.

For that reason, make sure to choose a variable copay solution that includes comprehensive member engagement tools, such as price and quality transparency solutions that guide members to high-value, low-cost care options in a digital format.

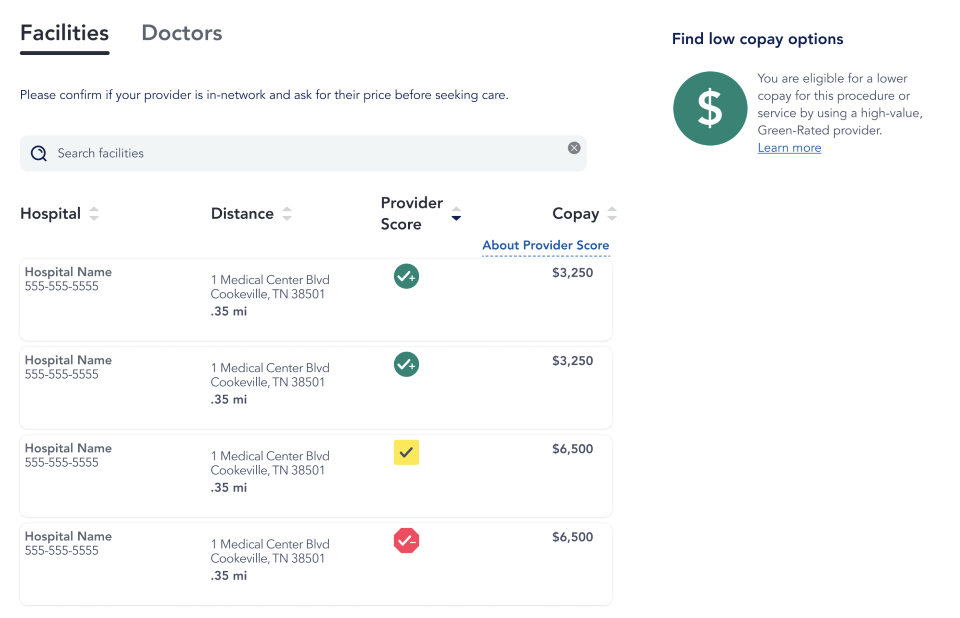

Take Valenz Bluebook, for example. By mapping every provider to a clear, predictable price, our price and quality transparency solution takes the guesswork out of care selection, efficiently educating members about their choices and the associated costs of each.

By incorporating this powerful tool into our Variable Copay solution, we identify and highlight those in-network providers who not only deliver the lowest cost but also the highest quality care, as informed by our industry-leading, unbiased quality and appropriateness of care dataset.

The result: A connected, value-based ecosystem that empowers members to navigate their healthcare journeys through an intuitive, easy-to-use digital interface, delivering significant cost savings for all involved.

For a more comprehensive member engagement strategy, consider supplementary tools such as pharmacy benefit management solutions and personalized care navigation — both of which can work in tandem with a variable copay model to direct members to high-value, low-cost care throughout their healthcare journeys.

Monitor the impact and make adjustments.

Implementing a successful variable copay model isn’t a “set it and forget it” situation. To maximize the uptake of this value-based care option, self-funded employers must commit to regularly monitoring and optimizing the program after the transition is complete.

Like many modern plan designs, a variable copay model can be tailored over time to best meet your employees’ personal care needs and wants. Regularly assessing their satisfaction with the program — as well as evaluating member uptake and cost trends — can identify opportunities for improvement and allow you to streamline the efficiency of your benefits strategy over time.

Gather feedback through surveys, conduct HR check-ins, and evaluate benefits usage data to determine how well your new model is working. If gaps or concerns arise, refine your strategy as needed — for example, with enhanced communication or additional healthcare tools.

A responsive, data-driven approach to the variable copay model ensures that employees feel supported while maintaining long-term savings and improved outcomes for all. Working with a partner like Valenz that is dedicated to your program’s success can make that process easier; your benefits strategist can suggest improvements based on your unique plan performance and using knowledge of what has worked historically for other plan sponsors just like you.

Maximize Savings and Improve Employee Healthcare Experience with Valenz Variable Copay

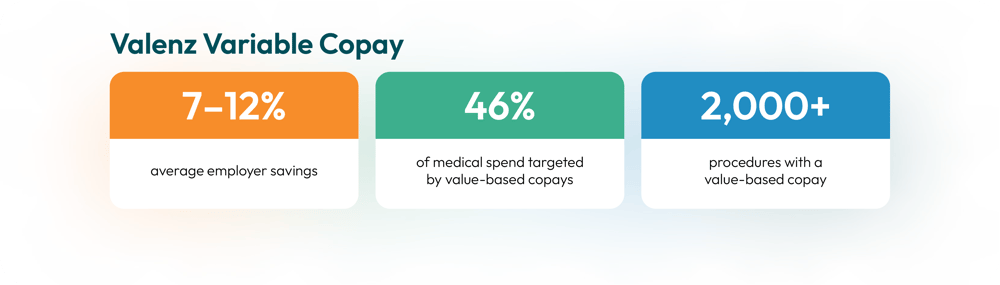

Not all variable copay programs are created equally. To maximize your potential cost containment and ensure the highest member satisfaction, look for a comprehensive, data-driven solution such as the Variable Copay program from Valenz.

Our Valenz Copay solution removes the red tape, confusion, and frustration associated with traditional health plan designs to embrace an innovative, cost-sharing model that engages members throughout their care journeys — supporting high-value care decisions with helpful cost transparency and navigation tools.

We align incentives for members and payers to drive higher cost savings for all involved in a self-funded health plan, guaranteeing predictable, upfront costs that enhance the member experience and reduce overall plan spend.

It’s our latest innovation in our ongoing mission to deliver smarter, better, faster healthcare for all — and the future of value-based benefits design for self-funded employers

As you look to contain costs for your organization and employees in the months to come, consider the power of a variable copay model. When implemented properly, this program can lower out-of-pocket costs, steer care toward high-value providers, and, most importantly, improve health outcomes by making essential care and medications more affordable — supporting strong, vigorous, and healthy lifestyles among a more engaged workforce.

Learn how our Variable Copay solution can help you control your healthcare costs — and usher in a new age of value-based care for your employees — by connecting with our team members below.