Rising healthcare costs and unpredictable high-dollar claims have made stop-loss insurance an essential financial safeguard for self-funded health plans. But, while it’s designed to mitigate risk, the cost of stop-loss coverage itself can be a significant — and sometimes overlooked — expense for plan payers, especially in an ever-inflationary market environment.

Understanding what drives these costs, how they vary by coverage type, and what strategies can help control them is critical for payers, brokers, and employers seeking sustainable health plan performance in 2025 and beyond.

Today, we explore how the average costs of stop loss medical insurance are changing, which three contributing factors are influencing stop loss pricing, and how smarter underwriting strategies can minimize those costs without raising the financial risks for self-funded employers.

Average Costs of Stop Loss Medical Insurance

The nature of stop loss insurance policies means that costs for self-funded insurers vary greatly. Factors including historical claims data, the number of covered members, and business needs all influence the final underwriting of the policy — which, in turn, determines relevant costs like deductibles, monthly payments, and more.

According to the 2024 Aegis Risk Medical Stop Loss Premium Survey, the average cost of a stop loss insurance plan ranges from to $46 per employee per month (for a $500,000 individual deductible) to $210 per employee per month (for a $100,000 individual deductible).

In other words, like all insurance plans, the higher an employer’s deductible, the less they’ll pay for monthly premiums. However, a higher deductible means more financial liability for the self-insured employer, who is responsible for all employee claims costs until the deductible is met (depending on plan design).

In a reflection of ongoing market trends, the Aegis survey also revealed average annualized increases in stop loss premiums of 10.4% to 13% and higher as deductibles increased (when comparing 2022 to 2024).

The bottom line: Like many services in the healthcare industry, stop loss insurance policies are becoming more expensive, which is why the underwriter you choose can make a measurable difference in your stop loss costs. Underwriters with deep expertise (like those at Vālenz Health®) use a wealth of internal and external data to predict your anticipated claims and design a cost-effective plan for your business needs and goals.

To discuss your organization’s stop loss needs and eligibility, reach out to our team members today.

Factors Driving Stop Loss Cost Increases in 2025

Self-funded employers face higher stop loss costs than ever, in terms of both administrative plan expenses and related member claims.

In most cases, this consistent growth can be traced back to three contributing factors:

- Increased costs across the healthcare ecosystem

- Higher utilization of more expensive treatments

- Care utilization returning to pre-pandemic levels

1. Increased Costs Across the Healthcare Ecosystem

Ongoing inflation continues to challenge Americans, and nowhere is that economic trend felt more than in the healthcare space.

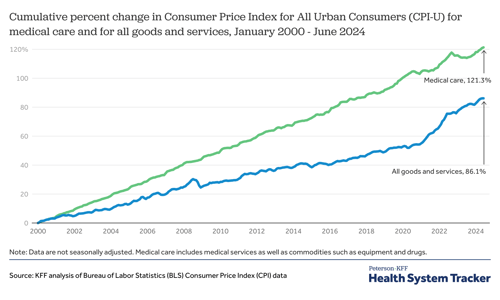

Medical care prices and overall health spending regularly outpace overall spending in the United States. In 2024, prices for healthcare-related services increased by 3.3% year over year, at a higher rate than overall prices (3.0%). In fact, when looking at the overall price of medical care compared to that of overall consumer goods and services from 2000 onward, the difference is staggering: a 121.3% increase for the former and an 86.1% increase for the latter.

Unfortunately, industry leaders predict those prices will continue to rise. The PwC Medical Cost Trend anticipates an 8% increase in overall healthcare costs for 2025, the highest rate increase in 13 years.

While the rising costs of labor and supplies are an obvious inflationary factor, other trends shoulder some of the blame, too, including:

- An aging population, for whom average inpatient hospitals costs are double that of younger age groups

- Cost-shifting from government programs, including cuts to Medicaid/Medicare and financial subsidies for healthcare organizations

- A nationwide healthcare worker shortage, especially among primary care physicians, advanced practice providers, and nurses

All of these factors put pressure on an already stretched healthcare system, driving up claim costs which, in turn, influence stop loss insurance underwriting. The more expensive healthcare becomes on average, the more risk self-funded employers expose themselves to — and the higher the cost of comprehensive financial protection for their businesses.

2. Higher Utilization of More Expensive Treatments

At the same time that overall healthcare costs are rising, Americans are frequently using more expensive treatments at a higher rate — primarily those that treat certain cancers, genetic disorders, and other debilitating diseases.

By 2034, the global cell and gene therapy (GCT) market is set to reach $75 billion, an increase of 27.94%. In the meantime, these growing pains are borne by today’s health plans, with GCT drugs used primarily for cancer treatment making up 80% of the top 10 highest-cost drugs in stop-loss claims.

All of this adds up to higher (and more frequent) member claims than ever, with industry leaders reporting a 55% increase in million-dollar claims and a 255% increase in $5-million-dollar claims since 2018.

As the conditions requiring these expensive treatments become more common, expect to see related costs grow. Unfortunately, while 73% of plans expect cell and gene therapies to pose a “moderate or major financial challenge” in the next few years, nearly 40% do not employ any financial protection to manage that financial risk — highlighting the need for investing in effective stop loss insurance today to protect your company from tomorrow’s claims.

3. Care Utilization Returning to Pre-Pandemic Levels

After years of delayed treatment due to COVID-19 concerns and restrictions, healthcare utilization returned to pre-pandemic levels in 2022 — but the costs of that delayed care will continue to be felt in the decade to come.

In response to pandemic closures, 41% of Americans reported delaying necessary care in 2020, a choice which may have increased morbidity and mortality risk among those with underlying, preventable, and treatable medical conditions. In fact, those people with disabilities or two or more underlying conditions were more likely to delay or avoid urgent or emergency care during the pandemic, risking the compounding health (and financial) effects of untreated chronic conditions.

As an effect of delayed preventive screening, conservative modeling from the National Cancer Institute predicts nearly 10,000 additional deaths due to breast cancer and colorectal cancer over the next decade. Add in the costs of treating those conditions, and the future effects on stop loss insurance policies are clear to see.

Even when you exclude the cost and burden of these serious health conditions, the return to pre-pandemic levels of care in an industry facing severe staffing shortages and inflation have led to higher costs all around. Unfortunately, the stop loss industry has not kept up.

By viewing cost plateaus from delayed care in 2021 and 2022 as credible experience (rather than a unique generational event), stop loss underwriters artificially suppressed rates — an error that many are trying to remedy with cost increases as the market hardens around them heading into the second half of the decade.

How to Minimize Your Stop Loss Expenses with Smarter Underwriting

While the costs of stop loss insurance are unlikely to decline, this financial protection doesn’t have to be unaffordable for self-funded employers. Smarter plan design — including a data-driven underwriting strategy — can create policies that protect payers from skyrocketing costs without breaking the bank.

Because stop loss underwriting is informed by historical and current claims data, the more comprehensive your data sources, the more effectively underwriters can design a plan specifically for your business. This includes setting deductibles and monthly payments that meet your financial expectations, as well as coverage that accurately predicts your members’ costs and protects you from the worst-case scenarios of extremely high-cost claims.

At Valenz, we take an integrated approach to underwriting, using data from the entire patient journey to inform our stop loss insurance policies. The result: Stop loss underwriting and plan design that delivers more effective savings for self-funded employers while minimizing financial liability.

(To prevent unsustainable cost increases at renewal, we also proudly offer “no new laser” options to those who qualify, protecting you from the effects of unexpected high-cost claims linked to specific plan members.)

By uniting our stop loss strategy with proactive care management, cost and quality navigation, and robust payment integrity tools, we offer an industry-leading approach that vastly improves care outcomes while delivering measurable savings — a solution we call ValenzONE.

Learn more about our healthcare plan optimizer by contacting a team member today.

Explore Stop Loss Solutions with Vālenz Health®

As the cost of healthcare in the United States continues to rise, so will the costs of associated stop loss insurance plans. Smarter underwriting and plan design can help offset these rising costs and expenses, and the team at Valenz is here to help.

We underwrite stop loss coverage for organizations of varying budget needs, with plans for groups of 11 participating employees and more. From specific stop loss to aggregate stop loss policies, we can design the perfect policy for your unique risk characteristics and business needs, protecting your bottom line from unexpected high-cost member claims.

Learn more about our stop loss offerings — and discuss your individual organization’s needs and eligibility with our experts — by contacting our team below.